Zonia project

Company > Properties > Zonia

Project Overview

The Zonia Copper Oxide Project in central Arizona has been held under private ownership for almost 100 years and has undergone extensive historical exploration, metallurgical studies and mine development planning. The majority of the mineralized area was pre-stripped during previous open-pit mining operations at Zonia in 1966, as 17 million tons were mined with 7 million tons stacked on heap leach pads, producing cement copper up till 1975. The Property has been drill-tested with almost 700 drill holes (60,000 meters). This high-density drilling covers 30% of the property and defines the current resource estimate, reducing technical risk on the deposit. Copper mineralization is mostly open to the northeast, providing a considerable opportunity to grow the resource.

The March 2018 historical Preliminary Economic Assessment (“PEA”) and 2017 historical mineral resource estimate on the Zonia copper-oxide deposit concluded that the economics of the project are excellent and gives World Copper the assurance to advance the project through feasibility.

The historical PEA is based on the 2017 amended resource estimate by Tetra Tech Inc. and outlines an open-pit, copper-oxide heap leach project with a 9-year mine life and favorable economics.

Now with our most recent resource estimate we are working on a Feasibility Study for a copper cathode sx-ew operation.

Ownership

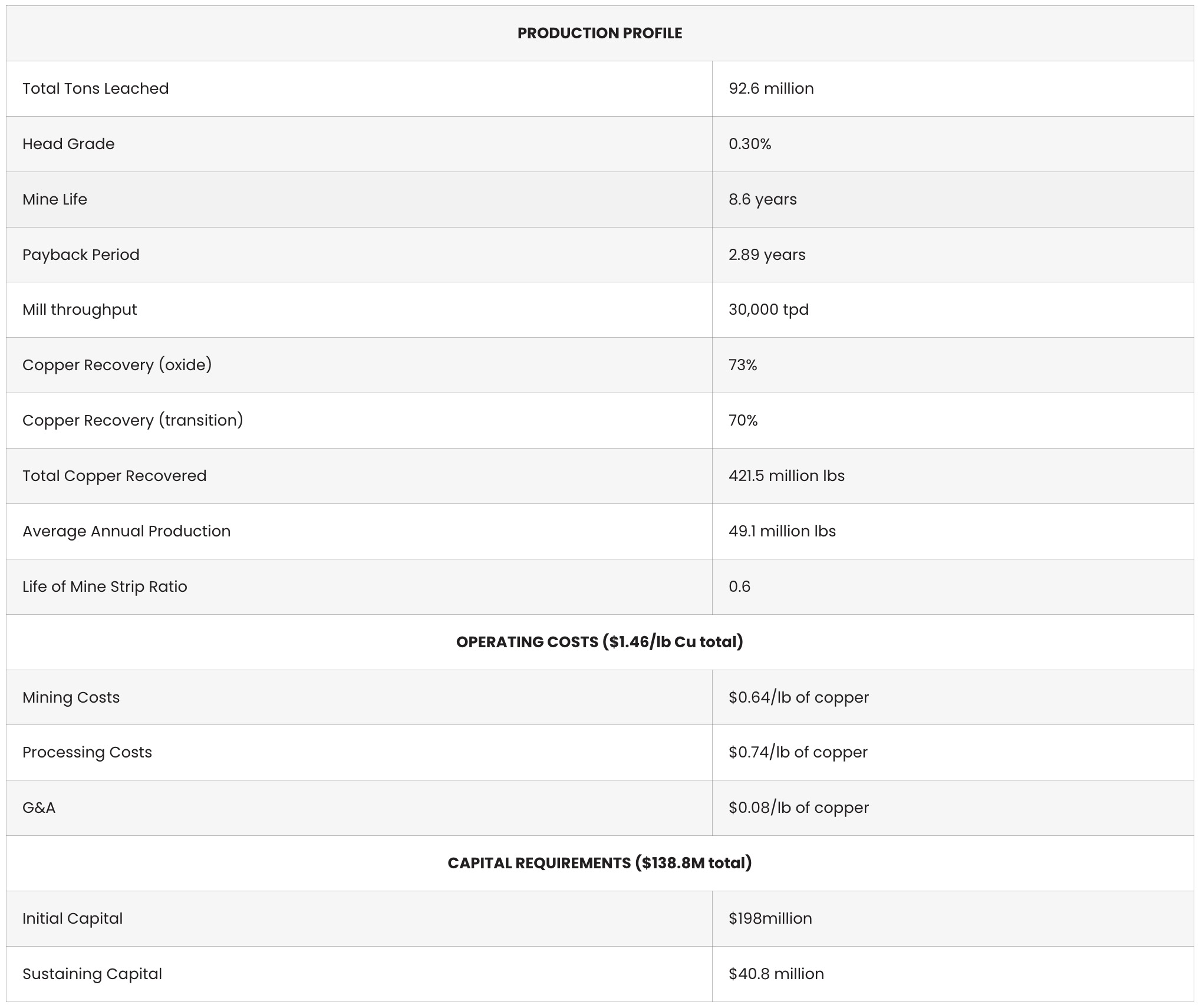

PEA 2018 (HISTORICAL)

Highlights

The base case uses a $2.00/lb designed pit shell with a grade cutoff of 0.17% total copper. At a copper price of $3.00/lb the economics are:

- After-tax NPV8% and IRR of $ 177 million and 29 %, respectively, with a 2.89 year payback of initial capital

- Initial capital of $198 million

- Cumulative Net Cash Flow After Taxes of $331 million

The PEA was prepared by Global Resource Engineering Ltd. (“GRE”) of Denver, Colorado, in accordance with the Canadian Securities Administrators (CSA) NI 43-101. GRE reported on the scoping-level capital and operating costs, and project economics associated with the potential development of the Zonia copper oxide project.

The PEA is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The full report is available on SEDAR or can be downloaded using the link below.

Zonia Preliminary Economic Assessment 2018: View PDF

The following table summarizes the main aspects of the PEA study:

Sensitivities

GRE evaluated the after-tax NPV@10% sensitivity to changes in copper price, capital costs, and operating costs. The base case project scenario produces 92.6 million tons of leachable material over an 8.6-year mine life. The project is most sensitive to copper price, then operating costs, then capital costs.

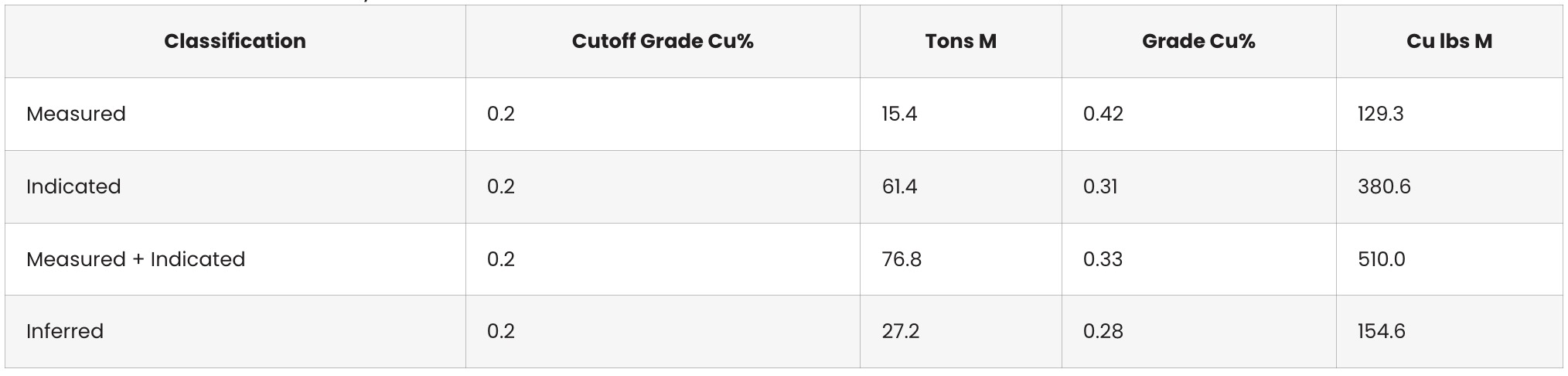

HISTORICAL MINERAL RESOURCES (USED IN THE PEA)

2017 Tetra Tech Resource Estimate

For the 2017 Mineral Resource Estimate (amended from 2016), Tetra Tech (“Tt”) completed an independent mineral resource and reserve estimate of the contained copper in the Zonia deposit. The following table shows the Tt estimated Zonia classified mineral resources at a base case cutoff of 0.2 % total copper (“TCu”). Mineral resources were reported within a Whittle(r) shell generated using the Lerchs-Grossman algorithm using $2.50/lb copper. Mineral resources within an optimized shell are not mineral reserves and do not have demonstrated economic viability.

Tetra Tech 2017 Zonia Classified Mineral Resources Base Case

Notes:

- Resources are stated within a Lerchs-Grossman optimized shell using the following parameters:

Mining (ore and waste) $1.5/ton, processing $3.4/ton, General and Administrative $0.45/ton, oxide recovery 73%, transition recovery 70%, and Cu price $2.50/lb - Columns may not total due to rounding, and

- One Ton is equal to 2,000 lbs or 0.9071847 Tonnes.

- Inferred Mineral Resources: It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

For the PEA, GRE used the 2016 Tetra Tech block model to generate new pit shells at metal prices from $0.50/lb to $5.00/lb Cu, in $0.25/lb increments. Preliminary analysis indicated that the $2.00/lb pit had the greatest potential for economic success. The pit shell for the $2.00/lb pit was imported into Geovia GEMS(tm) to design the ultimate pit layout using 45 degrees batter angle, 20-foot bench height, 12.7-foot bench width, 10% ramp grade, and ramp width of 100 feet for all but the lowest four benches, which were given a single-wide 50-foot ramp width.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves. Inferred resources are that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

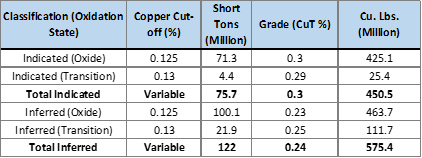

Updated Mineral Resource Estimate

The updated mineral resource estimate, announced on February 23, 2023 (see News Release), includes 75.7 million short tons grading 0.30% total-copper (Indicated Resources) containing 450.5 million pounds of copper and 122.0 million short tons grading 0.24% total-copper (Inferred Resources) containing 575.4 million pounds of copper, which is a significant expansion of the Historical Resource Estimate.

Updated Resource Estimate highlights:

- Indicated Resources of 75.7 million short tons grading 0.30% total-copper containing 450.5 million pounds of copper; and

- Inferred Resources of 122.0 million short tons grading 0.24% total-copper containing 575.4 million pounds of copper.

- Low strip ratio of 0.8:1 waste to mineralized material in base case mineral resource estimate.

- Significant increase in estimated resources compared to the historical resource estimate.

- Zonia Norte confirmed as next exploration target at the Project.

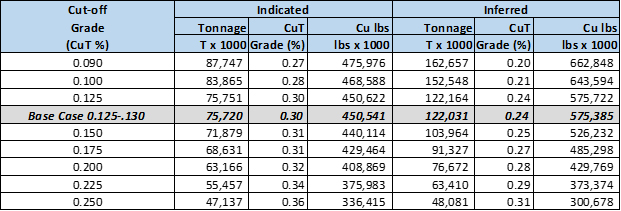

The classified resources are outlined in detail in Table 1 at the base case total-copper cut-off grade of 0.125 – 0.130% and at a range of total-copper cut-off grades in Table 2. The Updated Resource Estimate was completed by Richard A. Schwering P.G., SME-RM, of Hard Rock Consulting, LLC of Lakewood, Colorado (“HRC“), an independent qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101“), for World Copper as part of the Company’s overall exploration plan for Zonia (see news release dated May 22, 2022).

Notes:

- The effective date of the Updated Resource Estimate is September 1, 2022.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred Mineral Resources are that part of the mineral resource for which quantity and grade or quality are estimated on the basis of limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred Mineral Resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration (see “Cautionary Note to United States Investors“).

- Mineral resources are reported using a variable total-copper cut-off. The cut-off grade for blocks was calculated based on the following assumptions: a long-term copper price of US$3.60/lb., assumed combined operating ore costs of US$6.25/ton (low grade re-handle, process, and general and administrative costs), refining & shipping costs of US$0.15/lb. of copper, and copper metallurgical recoveries of 73% for blocks coded as oxide and 70% for blocks coded as transition.

- Mineral resources are captured within an optimized pit shell and meet the test of reasonable prospects for economic extraction by open pit. The optimization used the same mining costs of US$4.75/Ton mined and a 50º pit slope.

- Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Notes:

- Please see notes for Table 1.

Metallurgy

The Zonia project would employ open pit mining with a conventional copper acid heap leach system. The mineralized material would be crushed in a three-stage crushing circuit to a nominal P80 size of 25mm. The crushed material would be agglomerated with acid containing solutions using either raffinate or fresh sulphuric acid, and then be delivered to the heap via overland conveyor and grasshopper conveyors and stacked in 10-metre (m) lifts with a radial stacker operating in retreat mode. The heap is designed to contain up to 10 lifts for a maximum height of 100 m, each with an interlift liner.

The SX circuit consists of two extraction stages and one stripping stage using a conventional mixer/settler arrangement. The electrowinning (EW) circuit consists of two parallel banks of 50 poly-cement cells with 1m2 cathodes. The plated copper cathodes are stripped using a mechanized stripping system after being washed. Copper cathodes are then sampled and bundled for shipment.

Good copper extractions were achieved from the majority of the metallurgical samples at Zonia, and range from 59% to 81% in a 91-day locked cycle column leach test (excluding the high sulphide and low grade samples). The copper extraction from the master composite sample, with a nominal P80 size of 25 millimetres (mm), was 77.8%. The overall copper extraction based on the total copper assay (%TCu) for the deposit is estimated to be between 71% and 75%. For pit optimization, copper recovery has been assigned based on mineral type: copper oxide minerals at 73%, secondary copper sulphides at 70% and primary copper sulphides at 0%.

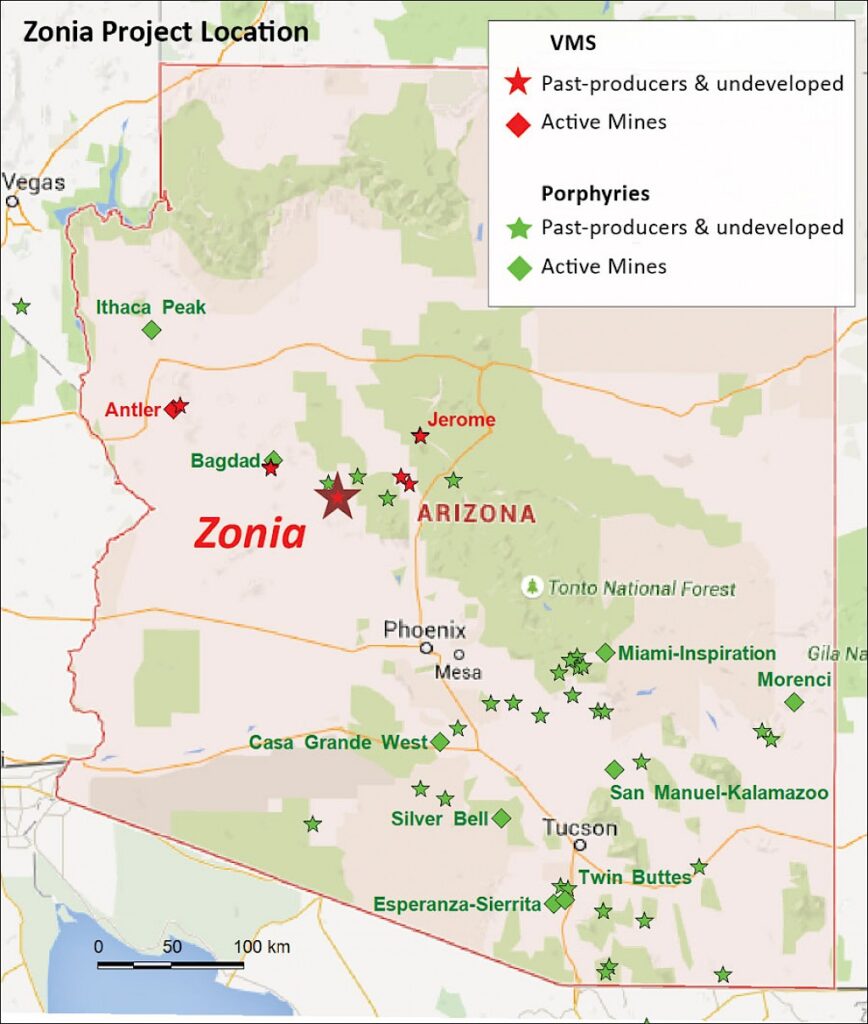

Geology & Mineralization

The Zonia property is in the southern part of the Basin and Range Transition province of the North American Cordillera, immediately south of the Colorado Plateau and north of the Basin and Range province. This section of the Basin and Range province in Arizona and New Mexico hosts a large number of base and precious metal mines and mineral occurrences. The Zonia deposit is hosted by the steeply dipping, northeast-trending, Precambrian Yavapai Series, which consists of schistose subvolcanic intrusions, volcanic flows, and tuffaceous sedimentary rocks. Portions of the area are covered by post-mineralization Quaternary basalt, fanglomerate, and alluvial material.

Rocks at the Zonia Property consist mainly of highly variably foliated quartz monzonite porphyry (dacite) subvolcanic rocks, diorite, and minor diabase dikes, with highly schistose phyllite and chlorite schist along the southeast margin. Foliation dips steeply to the northwest over most of the Zonia claims block, but changes to southeast dipping along the southeast margin in the Bragg Estate and Silver Queen claim block. This typical greenstone package is intruded and enclosed by younger Precambrian granitic batholiths which show only weak foliation at the margins.

Zonia appears is the highly oxidized portion of a previously supergene-enriched metamorphosed porphyry deposit, though it has also been interpreted as the stockwork zone of a volcanogenic massive sulphide (VMS) deposit. The main mineralized unit is variably foliated quartz-feldspar porphyry and related sericite schist, with disseminated sulphides and stockwork quartz-sulphide veins that appear to pre-date the metamorphism, but there is some evidence they post-date it to some extent.

Oxidation of the original chalcopyrite mineralization and younger secondary supergene chalcocite has been pervasive and deep, extending down over 250 metres (874 feet) in the central pit at the historical Cuprite shaft. Chrysocolla, malachite, azurite, melaconite, and cuprite are the most common copper minerals. Quartz and jasper accompany the ore minerals; oxides are ubiquitous in the mineralized zones. Higher copper grades are associated with contacts of the quartz monzonite porphyry with acid-reactive mafic chlorite schist, which are zones of increased supergene deposition. Lower grades are associated with more massive enclosures of the dacite porphyry, which were less permeable to supergene fluids.