Escalones project

Company > Properties > Escalones

Project Overview

The Escalones copper porphyry project lies 35 km east of El Teniente, one of the world’s largest underground copper mines, and within the renowned Chilean porphyry copper belt that runs north-south in the central Andes Mountains. The project has excellent infrastructure, including road access, electricity, access to seaports, and a gas pipeline that crosses the 70 square km property.

The Escalones deposit was discovered in 1996 through greenfield exploration work by Ralph Fitch, former President and CEO of General Minerals Corporation, and Felipe Malbran, the former Vice President of Exploration, South America.

In 2020, World Copper recognized that the shallow, higher-grade mineralization is significantly oxidized, rendering it mostly acid-soluble and potentially amenable to cost-effective, heap-leach copper production. Redefining the project as a copper oxide deposit significantly enhances its value by lowering costs of capital and operating development options compared to the previously contemplated sulphide flotation project.

Preliminary Economic Assessment 2022

- $1,499.6 million post-tax NPV8 at $3.60 /lb. life-of-mine (20-year LOM) copper price

- $1,822.4 million post-tax NPV8 at US$4.00 /lb. life-of-mine copper price

- First 5-years average annual Copper production of 124.7 Mlb. (56,520 tonnes); LOM average 114.9 Mlb. (52,131 tonnes)

- First 5-years average C1 (Cash Operating) costs of $1.13 /lb. Cu; LOM average C1 costs $1.19 /lb. Cu

- First 5-years average annual EBITDA $290.8 million; LOM average annual EBITDA $265.1 million

- Initial Capital (CAPEX) cost of $438.4 million (from construction decision)

- Life-of-mine Sustaining Capital of $192.5 million

- Conventional heap leach, SX-EW processing facilities, targeting 50,000 tonnes of heap leach tonnes placed per day

Mineralization & Geology

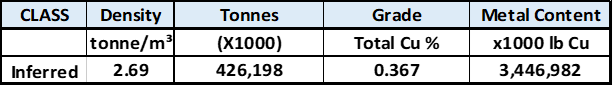

Mineral Resource Estimate Statement

Soluble Copper Mineralization

Exploration - Escalones Expansion Targets

The Escalones deposit remains open to expansion laterally to the south, east and west, with only roughly half of the alteration zone drilled to date. The Mancha Amarilla lithocap (“Mancha Amarilla”) extends one kilometre south from the main Escalones deposit. Evidence indicates this southern half of the Escalones alteration system is also deeply oxidized and could contain significant soluble copper mineralization. Geophysical and geochemical anomalies indicate there is also substantial expansion potential to skarn zones on both east and west flanks of the porphyry mineralization.

A geochemical sampling and mapping crew evaluated these targets in late February 2021. During the sampling programme, 336 samples were collected from the untested Mancha Amarilla lithocap and the East Skarn, which is a large gossanous wedge of mineralized sandstone and porphyry sills. The sampling helped define the most prospective parts of the lithocap and east skarn. Further details can be found in the August 12, 2021 news release.

The western margin of the Mancha Amarilla was tested in 2022 with six drill holes (1652m) along the main ridge. This small programme indicated the stronger mineralization lies under the steep, rugged west slope, necessitating road construction before it can be adequately drilled. Winter conditions closed the programme before the east skarn could be drilled. Further details are in the September 27, 2022 news release.

WORLD COPPER LTD.

Thank you for you signing up!